Note: The research below was first carried out nine years ago but is updated every year. The figures and graphs have been updated and republished on December 7th 2023 to include the GERS most recently published for 2022/23.

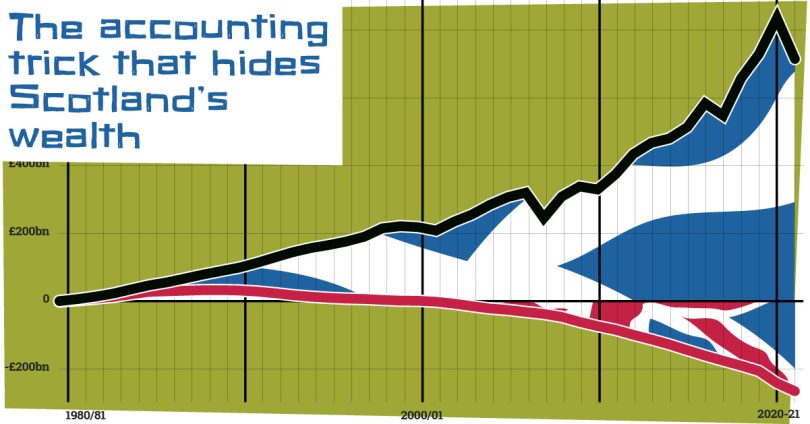

Every Westminster Government in your lifetime has knowingly diverted tens of billions of pounds of Scottish revenues to Westminster. This has led to lower investment in Scotland, higher unemployment, lower economic growth, lower standards of living, economic migration and growing inequality and poverty. All of which would not have been the case were Scotland an independent country.

Internationally, this is the sort of government behaviour that often leads to demonstrations and makes headline news. This might have happened here if it wasn’t for the fact that the Scottish people have largely remained unaware of the nation’s wealth draining south. In this article, we will expose the accounting trick that hides Scotland’s wealth. We will also supply undeniable evidence to demonstrate that if Scotland was already an independent country our economy would be booming and public finances would be debt-free.

The confidence trick

For generations, the people of Scotland have been fed a negative narrative on Scotland’s economy. A depressing picture of Scotland has been drawn by Westminster politicians, portraying it as a subsidised state dependent on the UK for charitable handouts, with higher levels of debt and a dependency on the public sector. Scotland has been told that without the generosity of the UK to bail it out, it would be a bankrupt nation, unable to meet the very basic needs and wants of its people.

This narrative is fundamentally untrue. There is simply no evidence to support it whatsoever.

So manifestly untrue, in fact, that all the available economic data entirely contradicts the age-old, absurd and tired Westminster proposition that Scotland could not succeed as an independent self-governing country. The “too small, too poor and too stupid” argument has become so completely discredited that none of the major players in the 2014 No Campaign dared to suggest it.

Politicians have retreated from suggesting that “Scotland’s economy is a basket case” as the truth is now easily sourced. The UK Government hid evidence, such as the McCrone Report, classified as top secret for 30 years by the 1970s Labour Government but is now publicly available. The report states that “the SNP had underestimated the nation’s oil wealth” and that an independent Scotland would “suffer from an embarrassment of riches”. That report was written in 1974 and classified as “secret” due to worries about “restless natives” if its facts were known by the masses in Scotland. It was eventually made public only after a Freedom of Information Act request in 2005.

A few years ago the former Chancellor Denis Healey in an exclusive interview with Holyrood Magazine said:

“Scotland “pays its fair share” and that “these myths” are simply perpetuated by those that oppose independence”. And that “Scotland’s oil wealth had been squandered by Westminster rather than invested, while being underplayed (in value terms) by the UK government to subdue calls for Scottish independence”.

It’s not all about oil though, as is made remarkably clear from the evidence in our publication Scotland the Brief. Scotland has everything that it takes to be an extremely prosperous and successful independent nation, and more. Scotland with only 8.1% of the UK population 4 possesses between 17-34% of the UK’s natural wealth.

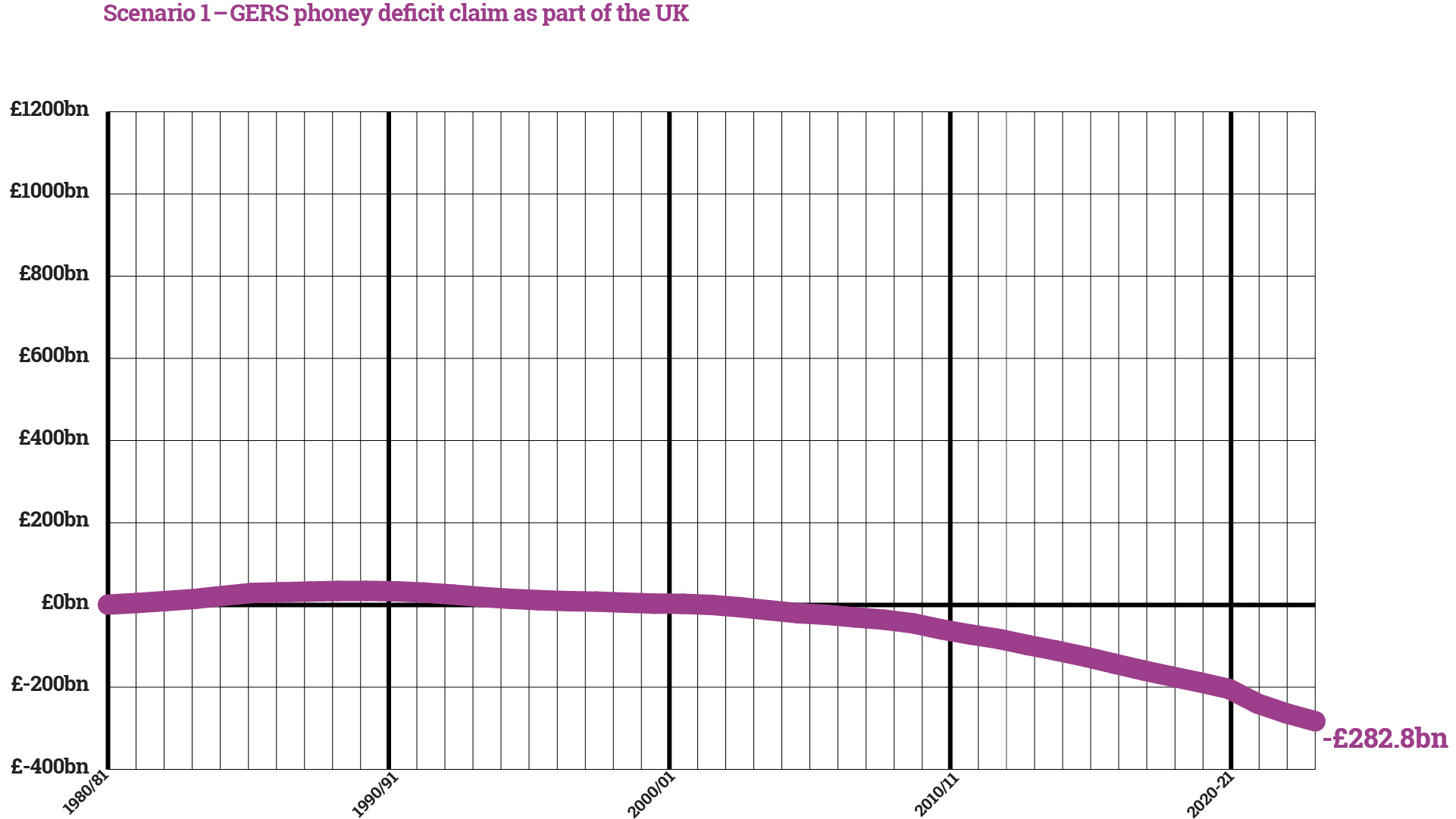

This prompts the question – why does a naturally wealthy nation with a strong, resilient and diverse onshore economy, booming exports, a highly educated population, low unemployment, a wealth of oil and renewables, and a wide range of strong economic sectors have a set of accounts (GERS) that suggest that Scotland’s finances are weak? That is a trick question, it doesn’t. GERS is not a set of accounts for spending in Scotland; it contains spending outside of Scotland that doesn’t benefit Scotland’s economy and that Scotland didn’t generate. GERS also contains clear evidence of mechanisms for removing wealth from Scotland’s accounts which then creates a phoney deficit. There are actually several hidden mechanisms for stealthily removing Scotland’s wealth. The one we will look at in this article is debt loading.

How debt loading works

There is an expenditure line in GERS called Public Sector Interest Expenditure (PSI). It is sometimes the fifth or sixth largest expenditure by the Scottish Government and is sometimes larger than Scotland’s allocated share of the UK Armed Forces expenditure. Historical analysis of GERS reports demonstrates that every year since records began, Scotland has been paying interest on a population share of the UK’s debts. In the last five years (2018-2023), PSI has added £30.2bn – an average of £6bn per year to the cost of running Scotland 436.

That’s not paying back the capital on any debt, it’s just the interest on the UK’s debt. Scotland has recently been granted very limited borrowing powers, but while the UK’s debt was being built up Scotland had no borrowing powers. In fact, Scotland’s economy was either in surplus, or had a lower deficit than the UK, so Scotland did not contribute to the creation of the debt.

How does a nation without the ability to borrow end up paying billions of interest on debt every year? It does so because the allocation of the debt is not related to the UK region or nation which generated the debt, nor where the money was spent or the economic benefit felt. The UK’s debt is allocated to Scotland’s accounts on a population percentage basis, even though Scotland did not generate that debt.

Looking at Scotland’s GERS reports (and earlier historical data) that go back 42 years, Scotland’s share of UK debt interest amounted to a staggering £156.7bn. However, analysing those figures also demonstrates that, for much of that time, Scotland’s accounts (even with the debt loading) actually showed a surplus. Were Scotland an independent country that launched an oil fund, as norway did, without the costs of servicing the UK’s debt, then Scotland’s entire borrowing requirements over those 42 years could have been zero, as any borrowing requirements could have been met with profits from the fund.Scotland’s accounts have had £156bn (one-hundred and fifty-six billion pounds) of interest on debt removed from them, despite the fact that Scotland did not generate, nor benefit from this spending. This has happened simply because it is not an independent nation and had to chip in to service the rest of the UK’s rising debts. Without that £156bn cost, Scotland’s finances would be in surplus today.

If we look back as far as reliable historical figures for Scotland’s revenues and expenditure go, we can see that in 1980-81, before the UK debt started to spiral, Scotland was charged £1.2bn to service the UK debt. Despite that, it managed to record a surplus of more than £1bn. Indeed, using GERS, Scotland’s finances showed a surplus until 1990, when the cumulative surplus amounted to £34.5bn (£54.3bn surplus without debt loading) 438.

It is undeniable that in an independent Scotland those surpluses would either have been invested to grow Scotland’s economy or possibly put into a sovereign wealth fund, similar to Norway’s.

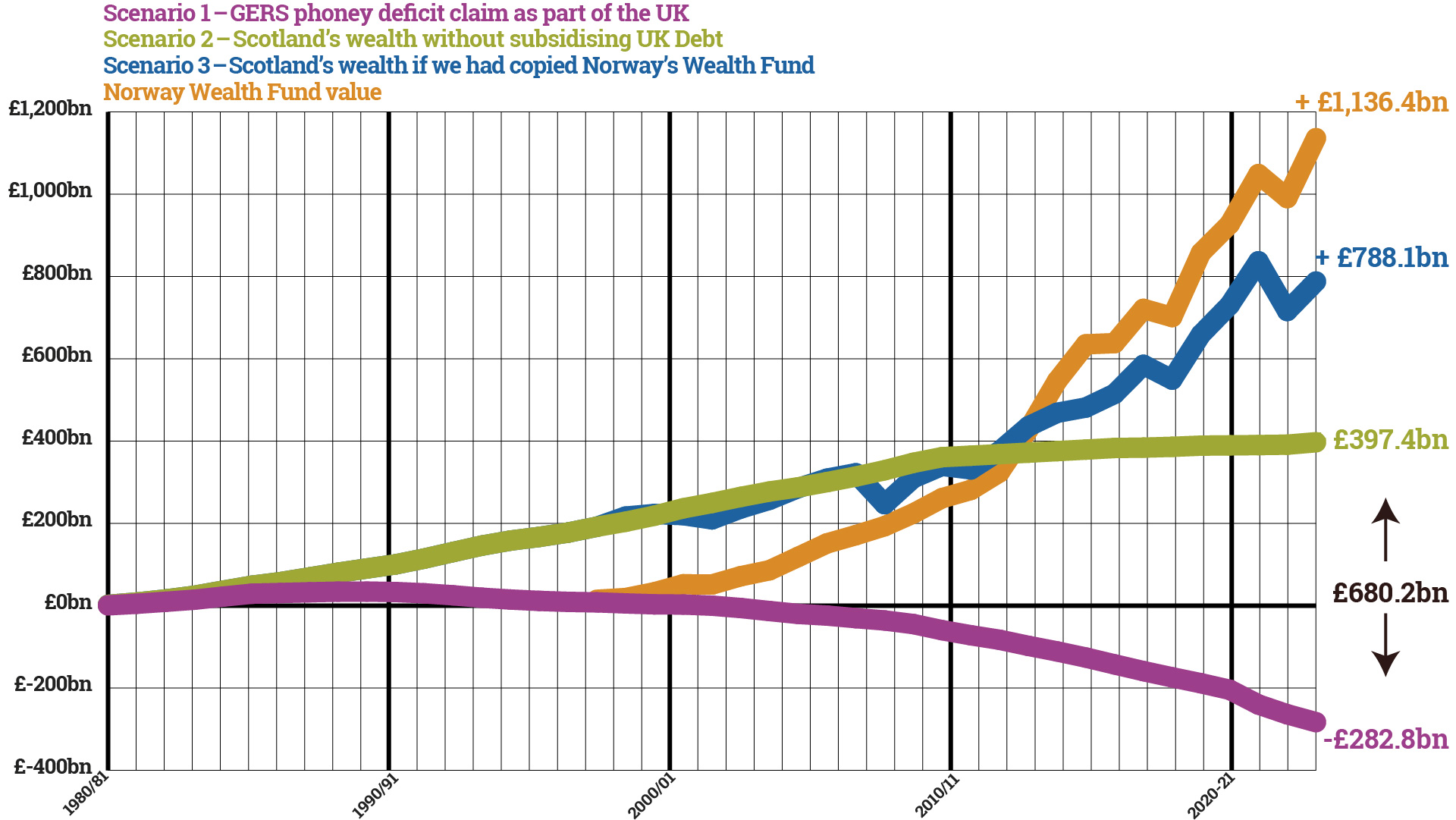

Let’s explore three alternative scenarios for how an independent Scotland could have managed its finances.

What the UK Government claims happened

Scotland was part of the UK and so past Scottish surpluses went to the UK Treasury, meaning that Scotland was actually subsidising the UK. Over time, the burden of the UK debt payments on Scotland’s economy started to weigh it down. This meant that the surpluses falsely looked like they declined during the 1990s and the cumulative surpluses were eaten up by UK debt-related deficits. As a result, the GERS reports now show a cumulative, but phoney, deficit of £282.8bn 439.

The UK debt is a mind-blowing £2,636.9bn, equivalent to 101.2% of GDP 440. Let’s be clear: UK debts have been growing steadily over those 42 years. Any budget allocated to Scotland’s accounts in that time that is of a higher value than Scotland’s revenues is not a subsidy, it is a loan that Scotland has to pay the interest on. A loan that Scotland only seemed to need because it was subsidising the rest of the UK and much of those loans was spent outside of Scotland and did not benefit Scotland.

It is a fact that as an independent nation Scotland would have possessed those cumulative surpluses and could have chosen to re-invest in Scotland’s economy. This would have grown Scotland’s economy significantly quicker than what has happened under Westminster management. An independent Scotland would not have accrued the £156bn of debt interest charges as it wouldn’t have needed any debt of its own.

That is why you can’t use GERS as an argument against independence. Allocating interest charges on debt that Scotland did not generate allows GERS to show a deficit. GERS assumes that those surpluses disappeared into thin air, and that could not have happened. It is an undeniable fact that in an independent Scotland those surpluses would either have been invested to grow Scotland’s economy or possibly put into a sovereign wealth fund for the future benefit of our nation, as Norway has done. So, what could Scotland have done with those surpluses?

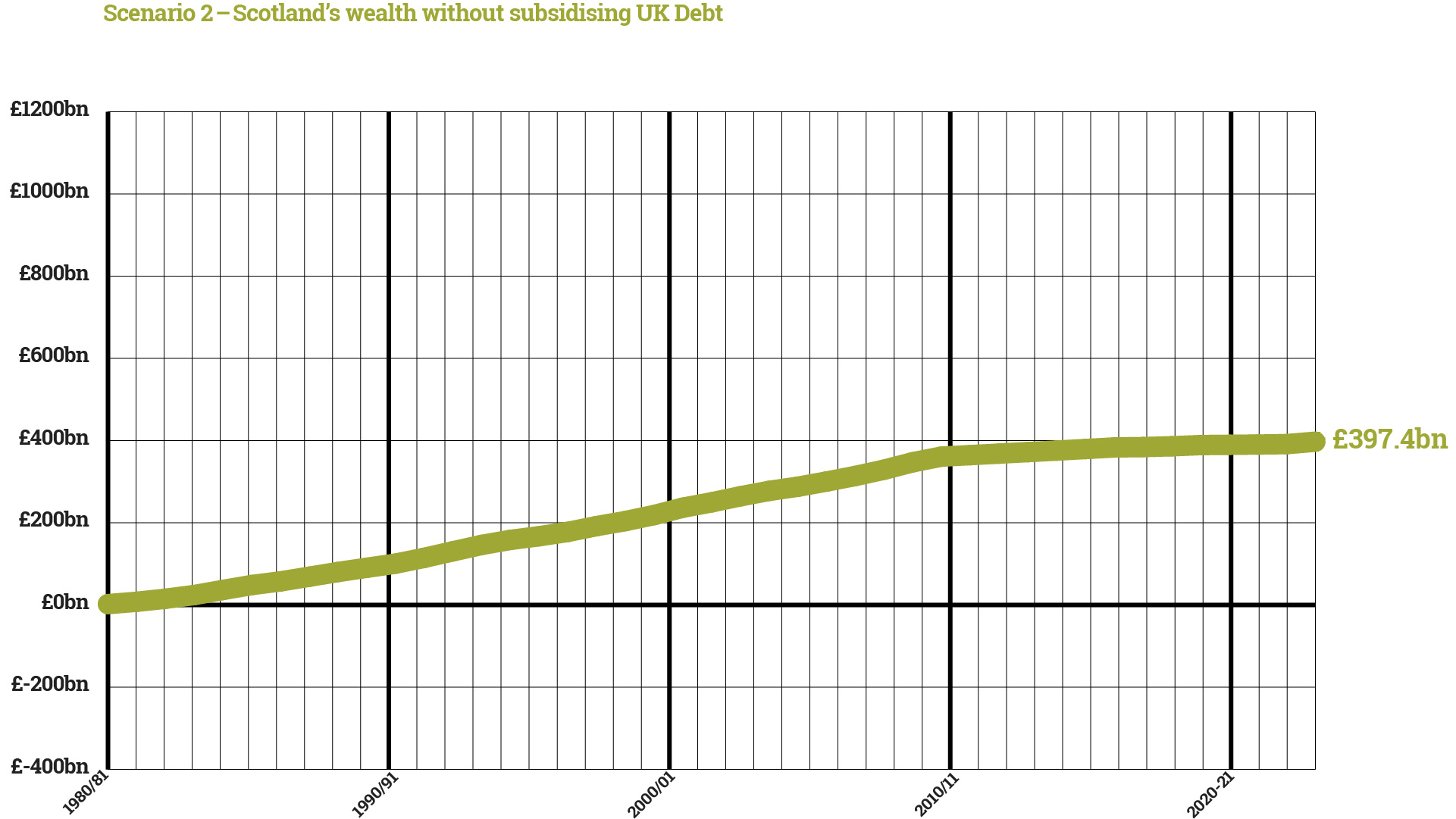

What’s the daftest thing Scotland could have done?

Assuming that an independent Scotland would not have gifted its massive surpluses to another country so that the other country could pay down its debts, what is the lowest rate of return an independent Scotland could have received on those 1980s surpluses? What if an independent Scotland’s government had been so daft, so absolutely incompetent, that it could not figure out how to invest those massive surpluses, and as a result, did nothing with them but stuff them into a bank and let them gain interest at the standard market rate?

Even in this case, that government would have had to have made significantly worse economic decisions, and more mistakes than Westminster did in running Scotland’s economy, to not see significant growth and better finances than those Scotland experiences as a part of the UK. What if we also assume the worst, and that even without those debt interest payments holding Scotland’s economy back, Scottish Government revenues didn’t rise, and that the economy grew much more slowly than other European nations with comparable populations, what would have happened? Note: we are making this as negative a projection as is humanly possible.

Well, those cumulative surpluses, plus standard bank rates of interest, would have grown until Scotland had £397bn in that bank account today 441.

Yes, that’s right, the daftest thing Scotland could have done as an independent nation would have left Scotland at least £680bn better off today than GERS currently suggests Scotland is, as part of the UK.

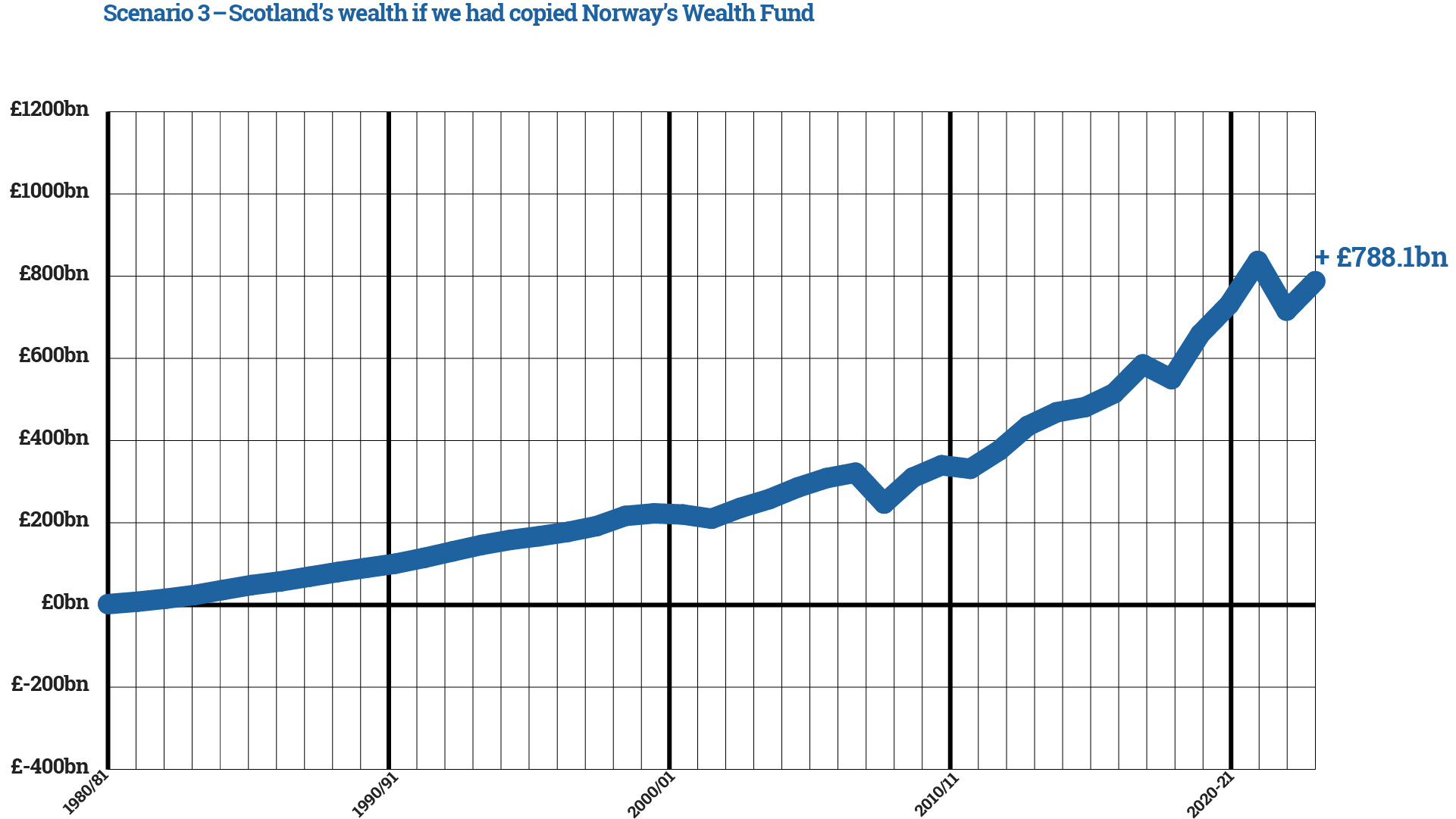

What would Norway have done?

Let’s assume Scotland’s government just banked the early surpluses until it noticed Norway was starting an oil fund and decided to copy it. Applying the same annual rates of return that Norway received on its investments since 1998/99, Scotland’s national oil/wealth fund would now be worth £788bn 443.

Remember that Norway is a small-to-medium-sized independent Northern European nation, with roughly the same population size as Scotland and has produced roughly the same amount of oil and gas. Norway’s sovereign wealth fund today is worth £1.1trn 444. That’s a lot more than I am suggesting Scotland’s would be worth because I have used the low revenues that the UK’s mismanagement of Scottish oil and gas resources generated, not the much higher Norwegian ones.

Over 42 years, the cost to Scotland of being part of the UK in monetary terms, if our government was almost as competent as Norway’s, is almost £1 trillion 445. That’s the difference between what Norway would have done and what the UK Government did with our surpluses. And people wonder why we have the second-worst pension in the developed world. Yet, the UK Government thinks it can’t afford to pay more.

Conclusion

It’s fairly simple and becomes extremely obvious when you have access to the data. The UK Government has diverted Scotland’s wealth to the UK Treasury to pay off its debts. Thus it creates 100% of Scotland’s supposed debts and 100% of its phoney deficit.

The daftest thing Scotland could have done as an independent nation would have left Scotland at least £680bn better off today than GERS falsely suggests it is as part of the UK. However, had the Government of an independent Scotland simply copied Norway, then Scotland would now be £1 trillion (trillion pounds) better off than GERS suggests.

This is the impact of Westminster’s debt loading alone, and upon that accounting trick, rests the entire economic case for the Union. There must be a better explanation to the people of Scotland about what GERS actually says and that Scotland does not have a deficit.

So would an independent Scotland have to pay the rUK a population share of the UK’s historical debt? No – there is in fact a very strong case for Scotland to be compensated for having already paid more than its “fair share” of the UK’s debt, whilst being told that wasn’t the case by consecutive Westminster Governments.

The research findings referred to in this article are contained in our book. You can purchase your copy of Scotland the Brief here.

Gordon, a first class piece of work. The challenge for us now is to spread the information by whatever means to as many of the Scottish population as possible and hopefully enlighten them. My Father was a boy soldier (15 years old) in 1914 and did not know what he was fighting for. The current task is great but we will be independent and the next referendum will give us our best chance yet.

The link to the Denis Healey article referenced above has changed to

https://www.holyrood.com/editors-column/view,still-raising-eyebrows_11042.htm

Gordon,

Please could you reassess the report assuming that we are where we are and what does the future look like for an independent Scotland.

Looking back at past potential doesn’t give a true evaluation of the effect of independence going forward, that horse has bolted.

Oil will be on its knees in 5 years. That is why Norway is now diversifying away from fossil fuels.

Norway currently export fossil fuel energy to other nations including the Uk.

They retain green and very low cost electricity which produces 90%+ of their power.Norway are now looking to provide Carbon capture to other nations, utilising the redundant oil wells.

If Scotland followed Norways ability to map its own future it would need to share the revenue for similar projects with WM as the NS infrastructure was created using WM capital.

Scotland could be a world leader in renewables such as tidal , hydro, wind power but being linked to EU protection of the environment is likely to be too restrictive to allow the development of these sources of energy.

What effect would direct contributions to the EU have on your calculations? Assuming Scotland was a contributing nation.

Would the EU accept Scotland as a non contributor?

There would be 4 contributing nations supporting 23 non contributors.

And how would a Scottish fishing industry thrive under EU rule?

All in all it would appear the if Scotland was to break from the UK it would be better to remain completely independent rather than swap one paymaster for a much larger greedier conglomerate of 27 nations .

An analysis of what needs to happen next is in the pipeline, however the figures in the article are up to date.

Gordon,

Is this available yet. Why do the Scottish Government and the SNP not quote such figures openly and regularly?

I have seen figures where about ten nations are net contributors a d they include Germany, France and Italy as well as Spain and th e Netherlands. They are a majority of thr total EU population. Not really a few supporting all the rest. Contributions are one percent or less of GDP

I have always been interested in fishing and I believe Scotland has one of the best fishing grounds in the world round about us. I remember an argument about what we would do with all the fish if we got independence. Some guy said we didn’t even eat a quarter of the different species that are in our waters. I said so what, we could CCCE the rest. That is catch, cook, can and export. Think of the number of jobs that could be created in the fishing and fish/shellfish processing industry just from our waters alone. And we are a rich country in so many other ways as well. Just my take on it.

The Spanish and French boats which purchased Scottish fishing quota could have been made to land their catch here or in the UK by UKgov but they chose not to do this. Think about that, WM chose to forgo the jobs and investment this would have entailed.

Even as independent members of the EU we can do this. All those thinking Indy is a death knell for the fishing industry are badly informed. It can be very good for it.

I am trying to find the reference to the money received by Scotland from the UK government. I recognise tat Scotland puts money into the UK ; where is the record of what it gets from the UK government?

The Norway comparison is interesting. I understand Norway has very high income tax compared with the UK.

Perhaps a better idea than building a wealth fund would be to let the workers who earned the money get to keep it and use it as they see fit. We could make an independent Scotland a low tax economy.

Anyone think that would be a good idea?

They also have higher wages so thier net incomes after tax are far higher than in the UK. So if I offerend to double your income but also raise your taxes 25% and then funded essentual services far beter than now would you say Deal or no Deal? Also direct wage taxation is higher in Norway but when you add all the other additional costs NIC etc in UK you find that Norwegions only pay slightly more taxes but their wages as I say are significantly higher.

Norway has a similar tax rate as Scotland. I have paid Norwegian tax and it’s roughly 20%. I was surprised at how beautiful the country was and how much it reminded me of Scotland.

The Scandinavian taxes support the whole community and its development for a continuing strong future. Scotland needs to follow this guide to ensure we are all robust and thriving.

Great article. Can I ask how you calculated the cumulative total of £126bn PSDI? Having a discussion on this with someone who is querying the numbers & I want to be able to explain them to him.

Could we start a crowdfunder to print this and put it in every letterbox in Scotland .

We will be launching a crowdfunder this week, which will ai to put at least three leaflets with Scotland the Brief messages on them through every letterbox in Scotland.,

I must applaud you Gordon so many people in our country are blinded and deafened by the trickery of all UK governments for decades and believe what they are told by those in power. Crowdfundedr for your leaflets should open eyes. Here’s hoping

Trickery of Gordon Brown and Tony Blair?

[…] be interested in some of the areas we have identified as cost savings from independence in 2014: Revealed: The ACCOUNTING TRICK that Hides Scotland’s Wealth and Westminster charges Scotland billions of pounds in service […]

Get this out to everyone not just snp members convince the no voters when I share this it’s to my friends and family who all vote snp this should be part of a small booklet sent out to all households with facts and figures not like the 648 page scotlands future that people got but never read best of luck

We did last time and will be updating the figures and adding a killer twist in the next few weeks.

How do I make sure I see the revised version… can I request a copy please.

Thank you for this Gordon. It is very helpful. I have shared it amongst all my groups

I find this site explains these issues in a way that people who are not economic experts understand. Surely we need to set up conversations about having our own Scotland Bank where we can all start to put our salaries / money in. How about a list of businesses in Scotland and how successful they are, to start building confidence. IFS was set up by Osborne 2009 and they pay their salaries, so every time the quote independent IFS, needs to be taken with a huge HUGE pinch of salt. That GERS is was Iain Laing’s way of fooling Scotland so they can steal out our pockets. We need a set of books as accurate as the Westminster’s Pink Books are, and not the guesstimates that GERS is.

[…] of Scotland’s oil and gas to undermine the case for Scottish independence. Former Chancellor Dennis Healey admitted that this ploy was used in the […]

[…] […]

[…] some return from it? Some of this is being made clear by the 200 leaders in Business for Scotland (https://www.businessforscotland.com/revealed-the-accounting-trick-that-hides-scotlands-wealth/) who understand what’s going […]

[…] a fact for you. Westminster has lied to you as a Scottish citizen and on a grand scale, hiding her Wealth from her citizens for […]

[…] (https://www.businessforscotland.com/revealed-the-accounting-trick-that-hides-scotlands-wealth/) […]

lets break free from the money draining leech called Westminster

Great read but to convince the majority of Scotland to vote either yes or no this article has to be put in a more simplified manner so it’s easy to read. I have read it and yes it is perfect for someone with a little time to read it but the majority of working people today will only read bits of it and still not either be bothered or fussed about its meaning. I myself like it short and sweet to the point in realistic reading to understand it. I for one did not go to university or college and the majority of voters will be the same. We are not stupid or thick but remember we can all vote as is our right so for the right of everyone involved let’s cut out the drivel and keep it nice and neat.

Yes I’m with Dennis on this a truly great article but for it to have any meaning and influence to the masses with the attention span of a Nat must be simplified and abbreviated to carry influence

[…] couldn’t possibly be any tampering going on, could there? Hmm. Back in the day, 1985 I was at Uni and we were looking at oil […]

Great article. I’m following the independence debate with great interest. As a Welshman I will be sorry to see you go. I’ve watched the debates, read articles from both sides visited Better Together and Yes for Scotland soc net sites and spoke to anyone who knows more than me

From what I can see and understand there will be a considerable number (between 40 & 60%) voting no. What I have been unable to understand is why. Maybe someone could help.

Hi Robert, yes I understand what you’re saying, sad to see us leave too but Scotland has never been side by side with England’s Westminster, it has always been a subservient marriage soaked with inequalities. I rarely meet No voters here in Scotland, a lot of people unsure maybe. For me I can see a lot of fear being the reason for the NO statistic and ill fed information. Also, I’m not entirely sure of how accurate the figures are? For me it’s a no-brainer, I’ll be voting YES, and I pray that we can finally be free of Tory rule. I’m sad to sever a tie to our British family and friends who, like us, have had to endure a government that they didn’t vote for. Scotland has a chance, I hope England, Ireland and Wales don’t hold it against us but understand that it’s a way forward and perhaps a chance to follow change too?

The people you meet reflect the social circle you live in. I know hardly people who voted Yes last time and even fewer who would vote Yes second time round if that ever comes—God forbid. (And I use the word God in its true sense!)

Sorry but if you call on your God to stop your nation gaining democratic self determination like any other then you need to get your priorities sorted.

I voted no because the SNP is a socialist organisation even further left than the Labour Party. The main platform they start from is that the poor deserve more, and that anyone paying taxes is a target for their future taxation strategies. The current crop of Scottish politicians and some of the recently high profile men ( Gordon brown) have shown a staggering level of incompetence as regards money affairs. Brown sold our national gold stocks at less than 300 dollars an ounce, raided the pension system to such an extent that he destroyed the whole industry, by white anting it’s foundations. The debacle over holy rood house, the tram system in Edinburgh….my god the Victorians built it faster and larger than we did ! Sorry but all I see is a bunch of people wanting power over us, and they will do whatever they can to get it. Read animal farm by George Orwell, it’s only about 100 pages long, and you may have a less rose tinted perspective on independence.

I agree with what you say, but this drives me to independence. Your comments are much to do with the lack of political accountability in the UK. Democracy is lacking and politicians continue follow corrupt and unaccountable practices that have been with us for generations. Independence gives us a chance to change, to become accountable. Only then will projects like the trams,the gold and the building of holyrood become avoidable. You analogy of Animal Farm works both ways depending on your side of the fence.

If 25% of the population earn more than £30,000, Do you think that this is fair for the Poorer 75%?

So let me just get this right N. McQueen, you voted no because of SNP??? Independent Scotland would have been around forever, SNP wouldn’t have. All politicians are incompetent if truth be known but to reject independence over some gripes you have with SNP and vote to stay with the biggest criminals we have who are keeping our people in poverty is just shocking!!

Sorry N McQueen

But that makes, not one iota of sense? You voted no because the SNP is further left than Labour? Really, So when we consider that Labour are pretty much a party of the right, [along with the Tories] then being left of centre surely must be a good thing for everyone rather than the wealthy few?

You then go on to suggest reading “Animal farm”, as a way of [somehow] relating it to the SNP, having just had a dig at some of the biggest troughers in Scottish politics [Broon & Labour] I’m afraid you’re confusing “Socialism” from “Communism” from a “Social Democratic party”, like the SNP?

https://en.wikipedia.org/wiki/Social_democracy

The point then, was that if Scotland had become independant, it would have been Scottish Labour controlling Scotland NOT the SNP. They were merely campaigning on Scotlands behalf, since that is what it was set up for in the first place…..post indy is what ruined Labour, and NOT only in Scotland, due to their blatant lies and scare-mongering and worst of all, siding with the tories, which, in the end, cost them the general election too. Whoever was the chief planner for their election campaign must have been an absolute moron.

I think you are reading the wrong literature not everyone else.

Have you actually read and understood the article? And you would still prefer Westminster exploitation to independence, prosperity and a fair society?

[…] case is on the ascendancy. http://www.scotland.gov.uk/Resource/0041/00416075.pdf Revealed: The ACCOUNTING TRICK that Hides Scotland?s Wealth. : Business for Scotland School #indyref debate produces spectacular swing to Yes | Yes Scotland Yes wins Strathclyde […]

[…] January 6, 2014 / Financial, GERS / Permalink Revealed: The ACCOUNTING TRICK that Hides Scotland’s Wealth.Every Westminster Government in my lifetime has knowingly diverted billions of pounds of Scottish […]

Gordon,

Thank you for all you are doing to shine a light on the shocking injustices that have passed for democracy in this country. I am one who remembers his teen years overshadowed by the Cold War and the threat of a nuclear winter. I was brought up with the notion that it was my duty to vote but I cannot remember many elections when I felt empowered and voting seemed to be a lottery between the ideologies of left and right. The exception is of course in recent past and my hunch that devolution would move Scotland from seemingly continually whinging (because the facts were concealed from us) to developing an action plan.

For years we were told that removing the bridge tolls was impossible and economic development in Fife was penalised by tolls at both ends.

A YES vote will only strengthen the sense of purpose because we will be much better able to hold our politicians to account and we WILL get the Scotland we want!

I am not a party political animal because I always find the arguments around human behaviour too complicated to be simply represented by one side or the other. However, for the first time in my life, I have joined a political party – the SNP – as the white paper indicates an intent I fully agree with.

I have now found this and various other groups arguing well for independence and I can barely contain my joy! This simply MUST happen!

That is a true statement no labor or Tory government could deny is the truth.

The amount of money we have been conned out of over the years is ridicules.

[…] – no nationalist he – and examined in greater detail both by ourselves and, more expertly, by Business For Scotland, all concluding that had Scotland voted for independence in the referendum of 1979 (rather than the […]

The way I look at it is this, If the Tories want to keep us, there must be something in it for them. They wouldn’t be trying to keep us because they love us. Also, there is no political gain in it for them, as the old joke goes, there are more pandas In Edinburgh zoo than Tory MPs in Scotland. Therefore it must be a fiscal matter………

It’s fiscal alright. Uk debt is about 1.4trillion and rising. It is gradually crawling towards 85% GDP. It has only been allowed to go that high as its backed up by assets such as oil etc.

So in the event of a YES vote. The UK loses 10% of its GDP. So the debt is now 95% GDP and not backed with any oil. The markets will not accept this and the UK will be on it knees financially.

This in my opinion is why every major party leader has been here in the last week. Also Why Osbourne is giving the G20 a miss.

I really enjoyed reading this article Gordon and I admire how much time you have taken to reply to everyone. One thing that has always intrigued me about Scotland’s balance sheet is the question of how tax receipts are accounted for. I read somewhere once on another blog which argued that the figure for Scotland’s VAT for example is actually much higher, as VAT which is paid in Scotland to companies whose head offices are down south are accounted for as is they were paid in England? Is this true, and what of the case of the other taxes? The SNP always cite the GERS figures, but my hunch is that Scotland’s finances are actually much healthier because of this accounting problem in terms of VAT, and perhaps also Corporation Tax etc. Can you provide any insight here?

Thanks for this article. This is a bit off-topic, but do you think the reason Westminster was so keen to prevent devo-max, was because that would have meant losing revenue. I’m surprised they took the gamble, because a vote for devo-max would have safeguarded Trident and Britain’s “place on the world stage”.

Yes exactly the ability to tax and spend across the board would allow the Scottish Government to create a competitive advantage and also stop the subsidy that Scotland offers the Treasury. There are also issues around Devo max that make it easily to defeat – as a system of Government it hasn’t worked anywhere in the world (federalism does closest) and it transfers all powers to Scotland other than Welfare, Defence and international relations – along with taxation those are the three most important things you would actually want?

only one thing for it vote yes yes yes

cracking article,for years we have been lied to and cheated by each consecutive government.in 2014 we will have the chance to stand on our own.I never thought i would see it happen in my lifetime,it’s an exciting time ahead everybody should embrace it.

I agree,the time has come to break free from corruption and greed that goes on in Westminster.

The unionist politians of all persuasions have let our country go into decline,now it is time to get our pride back,i’m voting YES.

Hi Gordon

I have a few points I’d like to make about your article.

You state that Scotland has “a strong onshore economy” Using the historic GERS figures if you look at the onshore section you find that even after taking into account the £64Bn of debt interest payments an independent Scotland wouldn’t have paid Scotland’s onshore economy still ran a deficit of £140Bn.

You also state “Scotland’s’ borrowing over 32 years would have been zero, nil, nothing, no pounds sterling at all.” But you also state Scotland would have had ” a cash surplus of around £50 billion” over the same period. Again I used the same GERS figures you did and subtracted the debt payments each year. A different assumption I made was that an Independent Scotland would have simply paid off its share of debt in the first 2 1/2 years. The figures I obtained show a surplus of £54.3Bn but also a debt of £46.5Bn from the years when there was a deficit. If an independent Scotland had simply used it’s surplus to make up for deficit years the total surplus over the 32 years would be £7.8Bn. Obviously this doesn’t take into account interest paid on the surplus or the debt. To back up my findings if you look at point 4.27 here http://www.scotland.gov.uk/Publications/2013/06/9241/5 the Scottish Government states Scotlands total debt since 1980 should be £56Bn this includes the £64Bn of additional debt payments. If you take into account the £64Bn you get a surplus of £8Bn approximately the same as the £7.8Bn I found. Are you claiming Scotland would have a £50Bn surplus and zero debt?

Wayne

First Scotland’s onshore economy is 99% of the UK average in GDP per head terms – this despite the fact that Scotland economy has been growing more slowly than the UK’s for generations, due to lack of investment from Westminster. As a result you can say that oil and gas is a bonus to Scotland and that we have both a strong (compared to UK average) onshore economy and a strong offshore economy. Scotland’s GDP per head is £28,500 compared to the UK average of £24,350 and this relates to Scotland generating £10,700 per head in taxes compared to the UK average of £9,000 per head.

Taking oil out of Scotland’s figures and claiming that our economy looks bad is a regular trick of the Unionists but it doesn’t make sense, you would then be comparing apples and oranges – take finance out of England figures and hey presto we are back to Scotland’s figures looking better again. You can only compare whole picture with whole picture and oil and gas revenues form part of the whole picture for an independent Scotland.

In my calculations I have assumed that the Scottish Government would not have paid back the debt due in 1980 in the first few years and that is why my calculations assume that Scotland continues to pay 1980/81 debt interest (to reflect population share of pre-1980 debt)] Population share: from ONS mid-year population estimates for UK and Scotland.

My calculations do not look at UK debt or Scotland’s share of UK debt at all. They analyse Scotland’s public sector budget position and in particular what would have been the case in terms of a cumulative surplus or deficit had the Scottish public sector budget been managed independently. Had that budget been managed independently then the surpluses in the early time period would have been held by a Scottish Treasury and not have been spent in the rest of the UK – ipso facto you have to consider at a minimum that there would have been interest due on those surpluses and the cumulative interest on the cumulative surpluses would have been significant.

By simply deducting net surpluses from net deficits you have failed to take into account the time value of money which is a basic economics principle. The older the surplus the more interest it accrues. I would also like to point out that I do not agree with the deficit calculations in GERS as much of the spend used to calculate the deficits were on items that Scotland would almost certainly not have had such as Polaris, V-bombers and Trident for a start- however I left those in just simply to show the effect of the interest payment accounting alone.

The debt levels of an independent Scotland in 1980 would have depended on the outcome of negotiation just as they will in 2015. It is therefore not possible to add an accurate debt figure for pay back to these calculations. However, if you assume that Scotland would have inherited a population share of the UK’s debt in 1980, approximately £8 billion, then you also have to assume that the Scottish share of assets like the larger military facilities and resources of the time or far larger gold reserves held at the Bank of England would be higher.

Some of those assets, particularly the expensive ones, such as the Polaris nuclear weapons system or Vulcan long-range bombers would not have been required for Scotland’s defence, even in a Cold War context, so the actual debt level could have been negotiated to at an educated guess of £6billion at most. Given the massive surpluses Scotland was generating at that time, that £6 could have been paid back in the first two to three years leaving Scotland with a £1.7 billion surplus upon which to begin accumulating interest, if the government of the time had been short sighted enough to choose this path.

Off course if you add in complex assumptions such as paying back a share of the UK debt at 1980 prices you also have to factor in the very likely possibility that Scotland would have followed Norway’s example and started a sovereign wealth fund that may have reached similar values to Norway’s £450 billion fund. It is also entirely possible that the value of assets That the UK Government wished to retain would have wiped out the 1980 debt all together.

The most important point in all of this is as follows:

There is no way to look at the historic Scottish balance sheet figures and to come to any conclusion other than Scotland subsidises the UK through paying for debt that was generated and required outside of Scotland’s borders.

Wayne even your simple calculation demonstrates a cash surplus without the time value of money calculated and with Scotland having paid back the 1980 population % share of debt which I think is too high / a wrong assumption as I would not have paid it back immediately from the 80s surplus’s.

Scotland therefor subsidises the UK.

“I believe we will see a reformation within Scottish politics with at least three new parties all willing to work together on project Scotland as the one thing that stops them collaborating “the Union V Nation” argument will be gone.” Gordon, that says it all…….regards,

We need to review our current democracy. Perhaps we need to be brutal and go along th route of having NO political parties. No parties mean all of our MSPs would be independents with no WHIP to answer to. They would however have to listen to their constituents and action the needs and wants of the people they would represent. Localism would improve local democracy too.

[…] post: Revealed: The ACCOUNTING TRICK that Hides Scotland's Wealth … Posted in Health, Security, Wells-next-the-Sea | Tagged business, closeprotection, health, […]

This article is interesting but ultimately it is navel-gazing.

Do we need to go over the McCrone report? It was not ‘top secret’ it was simply civil service advice that would never be published (see Alex Salmond and ‘legal advice’ on EU’). It was revealed after the FoI Act came into force. Claiming a conspiracy is absurd.

Back on to ‘navel-gazing’.

First of all 1981 is a date of your choosing when North Sea oil first flowed. Why not start from 1945 or 1707? Why ignore all the years that Scotland benefited financially from the exploitation of the British Empire? Put simply you have chosen the date most suited to your argument.

Secondly you speak as if Scotland has been forced into the Union against its will. Scotland has – so far – chosen to be part of the Union, and at the moment looks likely to continue to do so. What you call an Accountant’s trick is the reality of having consented to being part of the Union over these years, including those years you have drawn as evidence. If Scotland had voted for parties wanting Independence in 1979, 1983, 1987, etc., and this had been denied, you would have a stronger point. But we didn’t: we consented to being part of the UK at that time, including consenting to being part of the parliament that voted on those budgets.

Looking back to what might have happened if we had voted for Independence back in 1981 is not a particularly strong argument to base the facts of the Independence argument today. And it is certainly not much of a basis to claim that the figures are an Accounting trick.

Chris I assume you deliberately confuse legal advice which is never published not in the Scottish parliament of the Westminster one with civil servant advice which is almost never classified as secret.

The McCrone report was classified as secret as the reports suggested that there could be civil unrest if the Scottish people new how wealthy they would be if Scotland were an independent nation. Former Chancellor (Heally) and former Energy Ministers (Benn) have admitted that attempts were made to hide this information from the electorate and so it wasn’t even released by Westminster after the 30 years rule came into force, only coming to light after a freedom of information request which was opposed by the then Westminster Government including Alistair Darling. It is therefor patently ridiculous and almost unbelievable that you should say there was no conspiracy – it is the very definition of conspiracy – its out, now lets just admit it and move on.

1981 / 80 just happen to be the dates that we have accurate figures for, there is no reliable data before that time. If I had to guess, i would say that the figures before that time would be better as it was prior to the worse effects of deindustrialisation / Londonisation of the UK economy and so likely that Scotland more than paid its way within the Union at that time as well.

The figures I have presented in this report do look at the past – a past she the Scottish people have been tole that independence was not economically viable when the opposite was true. A past when we were told we were heavily subsided by the rUK when in fact as i have demonstrated Scotland heavily subsidised the rest of the UK. You point about democracy is moot as the people of Scotland voted in favour of Unionists Governments only after being lied to about the wealth potential of the country – they may have voted differently with the true state of our economy in play.

In 1979 the people of Scotland also voted for home rule and were denied that by a legal change to the conditions of the referendum that was only brought in when a yes vote looked likely.

I may publish some more research that examine the historical data but I will absolutely cover projections of the future under independence as well.

It is not a moot point. It’s not as if we didn’t know that hell of lot of oil was coming in and as if the SNP weren’t using that very point to campaign on. All the time.

Do you think the people of Scotland were so stupid that they were duped into not realising that there was a lot of oil coming out of the North Sea and accordingly didn’t vote SNP?

The SNP campaigned on oil wealth on every election since 1974. Are you now claiming that this was a great secret which invalidates the result of every General Election since 1979?

The UK Government campaigned against the SNP claiming they were overestimating the oil and telling us the usual story that it was soon to run out when they had made a report secret that claimed the SNP had significantly underestimated the value of oil to the Scottish economy.

The SNP do not campaign on oil they say that oil is a bonus and point out all the strengths of the Scottish economy – they did major on oil in the past but not any more. The ideas that Scotland is dependent on oil and the idea that this referendum is all about oil is a political invention of the No camp.

Business for Scotland do not suggest that people should vote for any political party, many of our members and directors do not support the SNP as whole but do support the move towards using self governance to build a better country and stronger economy.

The yes campaign is based on the intelligent and worthy premiss that self determination, self responsibility and democratic accountability at a local level are worth having. The general onshore economy can be grown with investment and local control of economic levers and oil is just an economic bonus not the mainstay of the argument. We write about oil on this blog as it is one of the key areas where the people of Scotland have been misled and we want the truth out so that people know there is another side to the story.

Ignore the ‘yoons’, Gordon and many, many thanks foryour info, which will be circulated by many of us. Saor Alba.

Chris, I do not know how old you are, but I CAN well remember the scare stories, the lecturing about us being too small and too poor back in the seventies and yes, we were categorically told the oil would not last more than a decade, two tops. This was in the days when he huge shipbuilding yards, steelworks, all manner of manufactories and we were told the union was responsible for this good fortune, even though it was all ‘sunset’ stuff. The union we were told would safeguard what we had and give us more in the future. I really am not bothered about the economic sums, I am bothered about being willfully duped. As are many others. It will not happen again, we have had our eyes opened and the genie of truth and clarity is well and truly out of the bottle. To me and people like me, the Union stands for corruption in Westminster’s halls and duplicity. And the same lies are still being repeated almost breathlessly regarding oil and our economic strength and potential today. The game is up sir.

As far as McCrone is concerned, it is a case of :-

Fool us once shame on us, fool us twice shame on you Westminster .

I am old enough to remember the rubbishing of the SNP claims over oil reserves, and potential revenues, what we did NOT know was they were doing it, whilst at the same time, sitting on the McCrone report that proved the opposite.

So not just a , cautious opinion, but a huge lie as we now know.

But then Westminster, you have no shame, you will do anything you can to leech wealth not only from Scotland, but from all over Britain.

Risks, yes there are risks,

risks of voting No that is.

If we vote No we will get no meaningful powers.

(Because that is why they tried so hard to remove the Devo question from the ballot( why else)

The promised ‘powers’ , will be useless sops, IF any come at all.

Once the vote is over, and they get their No , there is nothing to incentivise them to deliver.

On the contrary , there are already cries for the government to cut the funding to Scotland after a no vote, (no matter how much more we are putting into the pot than we get out. )

And why will that happen?

Well because if you just put yourself in the Westminster politician’s position day one of a No vote, you are now in NO danger of losing the lucrative revenues from Scotland,( that is secured, for no quid pro Quo)

A No vote says Scotland has No negotiation position, and Westminster have made No guarantees of specific and meaningful new powers, just political ‘promises’ carefully worded by politicians and lawyers so you can walk away and ignore them.

In fact they can then actually continue to milk Scotland , and now for even more than they had done before, and there is precisely nothing Scotland can do about it, they will have us well and truly by the short and curlys.

(Well we can always beg for mercy, but that is about the size of it)

I have been on plenty of negotiating courses, This is a particularly hopeless negotiating situation to hand to them on a plate, and rely on their better nature an honour to deliver. If it happens, this will go into the teaching materials of an example of what NOT to do in negotiations.

Even more adventagious to Westminster will be that , the very people who you are now trying to get to support you in the next general election ,are going to be pushing you to ignore the vague promises you made on more powers etc, and to actually CUT the funding to Scotland.

(It is not hard to find these voices and calls from down South to cut funding , they are online. )

And these are just the ones stupid enough to speak out early before the vote- more will follow.

They will start screaming Barnett cuts at the politicians after a no vote, and politicians ,we all know follow the votes, not political promises.

Remember, the promises of more powers, are pathetically vague, and even if some trivial powers were given, nothing at all has been even promised about maintaining current funding,

(but you CAN believe that they will meet their promises on more austerity and cuts)

After a No vote Westminster’s politician’s ONLY concern , will be to win the UK elections, nothing else , the Scotland ‘problem’ has completely evaporated, and is immediately forgotten , ‘Scotland’ is kicked into the long grass to be ‘harvested’ for as long as the Scots will put up with it.

Well they fell for it once, they just might fall for it again, more fool them…

Gordon MacIntyre-Kemp.

You are absolutely right in what you say.

You will make a vast number of Scottish people very happy.

You have brought to light what the Westminster government really

are. they are controlled by the Jewish banking magnets. Rothschild.

Our sentiments are the banking magnets control everything in the

governments. You are also right when you say there was a conspiracy.Thatcher told her Tory government the Scottish people had not to be told about the amount of oil in Scottish waters. It was classified as secret.Just like the lie we were told by the Labour government under Tony Blair. that the Maratime border was moved from South of Berwick on Tweed up to Carnoustie. According to him was the wishes of the European Union. He is a down right lier.he moved the borders so the English government could say the oil was in english waters. The Scottish people are not a happy people at the moment.Independence is our right and we will take it by force if need be. The Westminster government have a lot to answer for.And if they don’t make restitution by giving us our independence peacefully.then they will feel the wrath of the Scottish people.

Chris

At no time since 1707 were the Scots people given the chance to give or withhold their consent to being part of a union with any other nation. There were riots in Edinburgh amongst the “ordinary” people when they found out those “nobles” involved in the Darien project out of greed and commercial stupidity were put in a position to sell out a people and a country they did not own.

What ever one’s view about staying or exiting the current union, no one with any decent principles can say that there is no need for a referendum (I note you did not say there was not)

The Scots nation have never completely been comfortable with this alliance, there has never been a time when Scots thought of themselves as being precisely the same community as our southern neighbours. It’s written in history over the last 300 years. It never has been “fait accompli” That is why this question never goes away, it’s why Scots sing different anthems at sports events other than that prescribed by Westminster.

During much of those 300 odd years many of our people (not least the female half) even had the opportunity to vote for anything never mind the opportunity to reclaim their nation.

In 1979 the Scots voted 52% for devolution, an infamous Labour MP Cunninghame stabbed his own nation in the back to maintain his own lifestyle by assisting Westminster in rigging the vote so that despite a majority progress failed, let it not be forgotten that never was a Tory or Labour party expected to acheive to enter Westminster what had been demanded of the Scots people to get their parliament.

The sad truth is that all through Scots history it has been the powerful, rich and greedy of our own people that have sold their nation for a bit of silver (Kings included)

As you have said that was then and it’s done now, where I disagree is that it cannot be part of the argument for Independence now. It is INTEGRAL to the argument for Independence because history has shown us that people in power and great wealth, use it to grip on to power for their personal benefit, we remain and may yet remain in a union because the media; TV, Radio and certainly whats left of the Press us their influence to belittle, bully and scare the electorate with a bewildering array of lies and unexplained half truths. They work on a basis of “tell big enough lies often enough the people will believe it” Not for the first time has it worked as history has devastatingly shown us. The less astute have in the past fallen, but they fell because power mongers and liars fed them lies and those who wanted to tell the truths had no access to to the powerful propaganda machines that they had then and still use daily now.

However this time, thinking Scots have the Internet. Go on Facebook, Twitter, Wings over Scotland and many other sites you will find tremendous debate and enthusiasm for Independence. The electorate can debate, get informed by so many different sources that they can work out an accurate picture of what the truths are. They can now watch TV News, read the Mail or Telegraph and work out the truth form the bull.

They can download reports as I did yesterday from the “Institute of Fiscal Studies” compliments of “ESRC” and discover that contrary to what the powerful Westminster bully boys told us on BBC TV NEWS- the document was actually quite positive about Independence, Scotland would have it’s challenges but so would the remainder of the UK-got a bit silly when it was saying that the road would get really rocky if they weren’t careful 50 years down the line if a Scottish government didn’t make changes”

We WANT an Independence government so we CAN make changes!

If you choose to go on these sites something might strike you (one) is that contrary to what the polls shown in those news papers where it is propaganda worthy and in the news paper owners personal interest to say that the “YES” vote is tiny (applies to BBC management also) the declared (YES) voters online are vastly in the majority.

What you also note is how many of the “No” voters are extremely belligerent and even abusive. Are YES voters never abusive or belligerent? Well of course it takes all kinds. I find that when you challenge the views of someone who is totally convinced they are right but have no argument to support it they often become extremely belligerent. But look at the numbers of who’s saying what and you will see the “Yes” voters are extremely positive and buoyant- Tim Berners Lee must be the biggest blessing to Democracy and freedom ever.

It has been said many times recently that Independence must be a matter for the mind not the heart. Cobblers- the Wright brothers didn’t say “hey we’ve got a few thousand pounds how can we spend it? I know let’s invent the aeroplane we can afford it. It was Wilbur we’re going to make a flying machine and be the first men to fly and nothing is going to stop us, where can we get the cash to do it”

I’m sure many businessmen on this site will recognize this and remember how their careers started with a dream and went on to have tangible benefit in their lives, but the dream and wish and the will came first.

We want to run our own country, we dream of freedom to make our own decisions. We have it in our hearts that we want to vote our own Parliament in, and vote them right back out if they don’t perform for the nation. We have it in our dreams and in our minds that only our own people in our own elected parliament should send our children to die in wars abroad, seemingly futile, fruitless wars with no benefit either to our nation or the lands they are fought in.

These dreams and principled desires come before any thought of how much will it cost.

Nations such as India and umpteen South African countries and Asian countries at the end of the second world war did not wait to look at the bank balance to see if they could afford Indepenedence from the “British Empire” many more walked away from the USSR when it broke down I don’t remember any otf them nipping down to the cashline machine to see if it was cool to go for it- they just took it and none of them came back to say “listen we’ve made a bit of a boo boo here” they did come hell or high water.

Scotland is different and lucky in that respect because we already know we are paying our bills and more, and we can do a lot better with Independence because with it the Westminster Parliament has to give us our cash line car back!

Secondly you speak as if Scotland has been forced into the Union against its will. Scotland has – so far – chosen to be part of the Union?

A Parcel O’ Rogues In a Nation

Scottish ” nobles ” who sold out their country

NAME Amount of Bribe £

Duke of Montrose 200

Duke of Athole 1000

Duke of Roxburgh 500

Marquis of Tweeddale 1000

Earl of Marchmont 1104

Earl of Cromarty 300

Earl of Balcarres 500

Earl of Dunmore 200

Earl of Eglinton 200

Earl of Forfar 100

Earl of Glen Cairn 100

Earl of Kintore 200

Earl of Findlater 100

Earl of Seafield 490

Lord Prestonhall 200

Lord Ormiston 200

Lord Anstruther 300

Lord Fraser 100

Lord Polwarth 50

Lord Forbes 50

Lord Elibank 50

Lord Banff 11 !!!!

Provost of Ayr 100

The Scottish people had no say in the mater.

You mention the bribes Doug, and you are of course right, but not only that, they paid off the debts of the rich and privileged, they also made them rich again, oh and yes they showered them with land and titles, but what did the ordinarily Scot get?

Well, not only did the ordinary Scots not get a say in the deal, but they got to pay back these debts to England who themselves were in huge debt they actually also got to pay back ( through taxes ) the now huge ‘UK ‘ National debt. of 14 Million!!

And if Darian,had been a success, would the wealth from that have been shared with the ordinary people?

Of course not, they only get to pay back their losses, never share in their successes.

Sound familiar?

We are doing it again just now.

Scotland never chose to be in the union,Scotland was sold down the river by the so called upper classes who were all rewarded by money and land and tltles,As Rabbie said “a parcel of rogues in a nation”.Ninety five per cent of scots didn’t want a union.I recommend a good book that explains what really happened at the Union of crowns,it’s called Thomas Moore of Huntershill.

Gordon,

thanks for a good and analytical article. I could only raise a couple of comments

1. I would expect North Sea oil revenue’s to be on a delclining trajectory. With fracking cheaper sources of extraction will prevail. Family members describe to me the low levels of capex which is being ploughed into North Sea fields. They see it with their eyes..

2 having had personal experience of living and working in Denmark and working regularly working in Sweden,Norway, Finland. Some of these countries Denmark and Norway have oil revenues. All of these countries have eye wateringly high social costs and taxation rates. My ex danish employees for example are numb with 66% income tax as an example and not for a high salary.

So the inevitable facts are your projections are historical. Short term perhaps Scotland would balance its books , longer term it will only with a massive rise in taxation never mentioned.

That’s perhaps not a popular view on this website. But I will vote no but again I compliment you on the analysis.

Why do I keep reading about investment in North Sea being at record high levels?

Public spending in Scotland counted at 42.7% of total GDP in the 2011-12. That is LOWER than the majority of EU-15 countries in 2011, significantly lower than countries such as Denmark and Finland.

Among other countries that spend more on public spending as a percentage of GDP and have little or no oil revenues (with the exception of the UK) are;

Greece, Italy, Portugal, Belgium, France, Netherlands Ireland and the UK.

There’s nothing even remotely “eye watering” (as if having a strong efficient welfare state is something be mortified about in the first place!) about social spending in Scotland.

DEFENCE on the other hand shows Scotland’s population share of UK defence expenditure is equal to 2.3% (£3.3 billion) this is higher than all other EU-15 countries bar the UK. And defence spending in the “longer term” as we all know is expected to have a “massive rise” managing the cost to maintain and upgrade trident.

Jim. Fracking will never be allowed in Scotland. The people are against it. so it is a non starter.

Please will someone bring these figures and facts into the public eye a bit more openly as we the public are very tired of being lied to and being spun at !

Is that not what we are doing at Business for Scotland – this article has had well over 10,000 views in first 24 hours, 4,200 likes and 354 twitter shares. When all of our research is complete we will publish via our think tank and push to the mainstream press. In the main time please everyone don’t just read but share:-)

Gordon,

Few people if any, mention the billions of pounds in VAT payments that go directly to the treasury from Scottish businesses…perhaps you could highlight it in one of your blogs? When people become aware that this money will go into Scotland’s coffers post independence it could sway thousands of undecided’s…keep up the great work you are doing.

[…] As an independent country Scotland would have enjoyed a massive cash surplus Every Westminster Government in my lifetime has knowingly diverted billions of pounds of Scottish revenue to Westminster. […]

Great blog Gordon, good to see some informed discussions taking place. It is someway from being an unbiased view though and does have a selective data ‘cherry picked’ feel about it. Most certainly with a desired outcome in mind. I don’t have any other data to counter your well thought through arguments but I guess that is what is missing from this whole debate, some truly independent (forgive the pun) analysis of what will most likely happen. Not what has happened since 1970 because, like it or otherwise, it will be 2014 if it happens and thats all that really matters now.

Mike there is no bias in the data – the facts of this blog in terms of the cumulative surplus Scotland would have had are not disputed by the other side.

In fact leading economists from the No Camp (that is to say ones that work for the Labour party and their salary and position depend on painting the worse possible scenarios) have done the same calculations (one said Scotland’s surplus was higher than I have suggested, I used a more conservative methodology) but drew the confusion that being part of the UK meant it was worth it to be part of UK – “UK = word power”, “nuclear weapons give us a seat at the top table in UN”, “veto on security council” more influence in EU etc meant it was all worth the money.

I simply draw a different conclusion from the same data I don’t think the price we pay is worth it at all as we use UN and EU influence in a way that the vast majority of Scots don’t agree with. Take a look at the data on debt interest and draw your own conclusions – you will see that the only counter argument is not that I have been selective with the facts but that “Scotland is no more a nation than say Shropshire” (Quote Tony Benn). If Scotland is not a nation neither is England, Northern Ireland, and Wales.

Present any data that seems to show a different view of Scotland other than the one I support that we are more than capable of being a successful independent nation andy will show you how its calculated and where the flaws in those calculations are – i may respond here os write a full blog on it. Let me be clear – There is no macro economic case for Scotland being part of the UK.

And finally re – selective and biased – I grew up in Hexham in Northumberland the place I still call my home town, a young conservative I came to Scotland to study business and economics. I decided to debunk the SNP economic claims and after only a few weeks realised that everything I had been led to believe about the Scottish economy was untrue. I didn’t change the data the data changed me, and the data will change anyone who looks at it with an honest heart and takes of their political blinkers will be changed too.

Gordon, understand there is no bias in the data. You will accept however given the overall thrust of the blog entry and the whole point of the website is to support the case for an independent Scotland that there will always be a perceived bias however untampered you present the data. My other point was it is backwards looking, i.e. what would have happened had this been the case. It is not forward looking. What is the longevity of the North Sea reserves. What happens if oil price drops back to $50/barrel? Are we a one industry country (or two if whiskey counts) How will Scotland support a 25/75 public sector to private ratio etc.. I am sure you will cover these topics, or might have even done so. For me its how will Scotland fare in the future, not how it might have fared. I do applaud your website/blog though as it is one of the few which do not drop down to the usual pipe and drum banging and is very far elevated above the No campaign’s fear of the unknown/zero-good-argument tactics.

Mike Can you please draw the conclusion from the data that Scotland is subsidised – if you can do so reasonably then my conclusions are challengeable, if not then they are not.

You ask what if oil half’s in price – well what if we vote No and the financial markets lose half their value? It is not enough to point to a highly unlikely scenario and say that is reason enough to vote no. The UK is more dependent on the more highly volatile finance sector than Scotland is on oil. If you take oil out of the Scottish economy it has the same GDP p/head as England ipso facto oil is a bonus a jackpot and jackpots go up and down but you would never say no to getting one from the lottery would you.

The OECD predicted an oil price of $158 per barrel in 2017 so why on earth is it plausible for you to suggest a price of $50. Please Mike all I ask is you think about the probability of these scare stories rather that repeat them without challenging them yourself.

PWC has reported recently that £350bn of revenue has been generated for the UK treasury so far from the North Sea and that there is $450bn of revenue still to come. £100bn of new capital investment into the North Sea has been announced and 133 new wells are being sunk. The london based trade body UK oil and Gas states there is between 40 and 60 years of production left and as oil becomes scarce the most likely scenario is that the pice will rise.

And finally Scotland public sector expenditure is less than the UK’s as percentage of GDP per head, in other words if you are worried about an independent Scotland public sector reliance worry more about the UK’s.

We are not a one industry economy there are many strengths to Scotland economy and oil and gas is never more than the low teens % wise even with growth and investment straggled for 32 years as I have proven in the above research.

Food and Drink, Tourism, Education, Creative Industries, Biotechnology, Exporting, Energy, Renewables (we have 26% of the EU’s renewable potential), yes oil and gas, but 40% of oil and gas related corporation tax comes from Scottish based firms exporting expertise abroad, not just from extraction, Non bank finance is also strong. We have a more balanced economy in Scotland that we do in the Uk as whole. http://www.scotland.gov.uk/News/Releases/2012/04/seveneconomicstrengths15042012

The whole idea of independence is to have the ability to drive our economy forward using the economic levers not currently available to drive the other strong industries forward and grow our on shore economy and invest / plan for a long term future when oil revenues to start to run out. Investment that won’t happen and will destroy our economy in the long term if we don’t start planning for it now. Westminster will let the oil run out and never reinvest as it’s priority in London, the leaders on an independent Scotland’s main priority will be sustaining Scotland.

Excellent article it’s a subject I have been banging on for more years can you can shake a stick at that we have been lied too

Another excellent article Gordon.

During the article you wrote:

“Every year for 32 years (the entire available data) GERS includes a deduction from Scotland’s block grant equivalent to Scotland’s population percentage share of Westminster debt.

Over the 32 years, Scotland’s share of UK debt interest amounted to £64.1 billion.”

Considering that the same figures you cite also show that during this 32 year period, we actually contributed 10.29% of UK GDP from just 8.3% of the population, an effective over-contribution per head of 24% per annum, did we not therefore actually pay 24% more in debt interest each year than the 8.3% we are credited for in cumulative £64.1 billion you suggest?

Or in other words, our economy was hamstrung by considerably more than even these figures stipulate, when you factor in the compounding effects of 24% extra interest actually paid by us each year on top of our 8.3% notional share.

If I am missing something, I look forward to be enlightened. Thanks. 🙂

James there are several ways of removing wealth from a region – for region is what Scotland is until next year – the major ways include:

1) Applying a population percentage share of the UK debt to Scotland even though that debt was not generated or spent here.

2) Applying a population share of capital spend / military spend and civil service spend to Scotland books that does not happen in Scotland and in some cases does not benefit and can even harm scotland. EG: HS2 when it could actually harm Scotland’s economy / London Olympics tax payer bill when the Glasgow Commonwealth games come exclusively from Scotland’s budget / London sewerage system upgrade paid for by public funds that are not effected by the Barnet Formula and it is owned by a privately owned company. On the upside this does mean that 8.4% of the Royal Navy, Airforce etc belong to Scotland after a yes vote – they can keep Trident and we will negotiate for some more conventional forces or less debt.

3) Creating a set of books for Scotland that does not include north sea oil / gas / corporation tax / export duties – calling these UK revenues and not applying them to Scotland so that it looks like we are being subsidised (I think this is what you mean in your comment above). Looking at these incomplete books allows the No campaign to state that Scotland therefor doesn’t have enough revenues to be independent / that public sector spend is too high. When in fact with all the actual revenues we would have as an independent country not only is our revenues and GDP per head higher than the average for the UK our public sector spend is a lower % of GDP that the rest of the UK – go figure.

And finally my all time favourite is when someone says ah yes but take the oil out… Well then Scotland’s revenues are the same as England’s! But wait if you are going to take oil out of Scotland books let me take finance out of England’s and – look – Scotland is in a better comparative financial position again.

So essentially Westminster took £4.1bn from Scotland in debt interest last year when we should have been cash rich, they then gave us £4.4bn less than our % share of revenues (by calculating Scotland’s block grant on population not revenue %) and then applied costs that Scotland doesn’t directly benefit from to our accounts for shared services, wars that Scotland’s Parliament voted against etc and I can only guess as I haven’t done the numbers YET that could be another £1.5Bn.

In 2011/12

– The chancellor set budget for England (then allocated population share to other nations)

– He then allocated 8.4% Population % share of spend to Scotland which happens to be aproximatley £11.4bn less than if calculated to match 9.9% fair share of revenues.

– He then deducted £4.1bn in interest to service loans we didn’t need

– He then deducted the costs of shared services whether they happen in Scotland or not, and whether we want them or not (maybe £1.5bn)

– He then added £7bn via the Barnet formula and says it is a subsidy – Happy Days 🙂 and that brings the shortfall down to £4.4bn in latest year.

– Westminster then implements policies such as the Bedroom Tax and failure to devolve Air Passenger Duties and Crown Estate powers etc that lower our revenues.

As the blog demonstrates an independent Scotland (since the 70’s) would not be in debt or run a deficit and as the figures above demonstrate a newly independent Scotland would be in a far stronger financial position than as part the UK.

If Scotland had to borrow money we would as an independent nation only have to pay back the loan and interest – but as part of the UK we have to pay that + the extra we contribute in revenues. So when Scotland runs a deficit we are worse off as part of the UK not subsidised.

Think that explains it? There is no economic case for maintaining the union.

Great article. GERS figures show that in 2012-13 6.3% of Scotland’s public spending (£4,072 million) went on ‘Public Sector Debt Interest’. I can’t find a comparable figure for the UK, but the UK deficit is something like 7.1% of GDP, UK public spending is about 45% of GDP, therefore a comparable figure for the UK has to be something like (45% of 7.1% =) 3.2%. Scotland therefore pays just about twice the interest rate for borrowing than the UK as part of the union. Puts in perspective claims by the NO campaign that Scotland would pay more interest on its borrowing if it were independent. But as Gordon says, this is interest on money borrowed the bulk of which is not spent on or in Scotland.

One point though, if I may. I’m not clear as to why Scotland’s’ borrowing over 32 years would have been zero if independent? Scotland has run a deficit, albeit a smaller one than the rUK relatively speaking.

Hi Iain the whole point of the blog is to show that Scotland’s cumulative surplus would have lowered in years where we ran a deficit and then risen again when we ran a surplus. The net result taking out the deficit years is a near £50bn surplus. If you pay for your deficits from a saved surplus then you don’t need to borrow.

The only reason that it looks like Scotland runs a deficit for much of the time period is that the UK debt was removed from our block grant as a cost, if it was left in we would have a massive surplus now even after accounting for the bank bail out costs and making same cost decisions on nuclear weapons etc which of course we wouldn’t have but I left them in to make my figures conservative.

So far from the UK government bailing out the banks Scotland has been bailing out the UK for the last 30 years.

Correct see the Tony Benn quote in my repines to Ross. Also the cumulative surplus scotland had at the start of the crash was larger than the cost to the UK government to bail out the Scottish banks and as I have proven before Scotland would have paid roughly the same amount as is being applied to GERS for the bail out anyway. The cost of the bank bail out is still in the figures so the £50bn we should have in the bank right now is after the cost of the bail out. Would we have had a collapse if we were independent – would we have had the same lax regulation and London – who can tell? So I have to leave that cost in – I however personally lobbied members of the BoE MPC committee in face to face meetings and the BoE head of Scotland in 2006 and 2007 to curb unsustainable and uncontrolled lending to avoid a recession. They didn’t listen and I have always wondered if a Scottish central bank (which we would have had then) might have been more open to my ideas?

Does that graph also assume that our share of -what, £150 billion- national debt vanished in 1985 during this hypothetical split and that it cost us nothing to create our own currency, national services and infrastructure?

Ross if you read the blog there are notes on the methodology that state that “calculations assume that Scotland continues to pay 1980/81 debt interest (to reflect population share of pre-1980 debt)] Population share: from ONS mid-year population estimates for UK and Scotland”

As it happens if you can provide evidence that a fair share of that debt was spent on Scotland I would be interested (and surprised) to see it. I can only go back 32 years as that is how far back the historic GERS figures go.